FHA Purchase New Jersey

The FHA program offers numerous benefits tailored to meet the needs of aspiring homeowners in New Jersey. Here's what you can expect:

Low Down Payment Options

FHA Purchase New Jersey provides an opportunity to purchase a home with a minimum down payment requirement as low as 3.5% of the home's purchase price. This makes it easier for individuals and families to enter the housing market, even if they have limited savings.

The FHA program recognizes that credit histories can vary, and it is more forgiving compared to conventional loans. While specific credit score criteria exist, the FHA considers alternative credit data and allows for lower credit scores, enabling more potential buyers to qualify for a mortgage. text...

Competitive Interest Rates

FHA loans often come with competitive interest rates, which can make your monthly mortgage payments more affordable. This benefit can save you money over the life of your loan, making homeownership in New Jersey more achievable.

Government-Backed Security

FHA loans are insured by the federal government, providing lenders with an extra layer of protection. This insurance mitigates the risk for lenders, allowing them to extend financing to borrowers who might not qualify for conventional loans, ensuring a smoother approval process.

Various Property Types

FHA Purchase New Jersey extends to a wide range of property types, including single-family homes, multi-unit properties, condominiums, and townhouses. This versatility gives you the freedom to choose a home that suits your lifestyle and needs.

Local Expertise

New Jersey is home to numerous FHA-approved lenders and mortgage brokers who specialize in the FHA program. They possess a deep understanding of the local real estate market and can guide you through the entire home buying process, from pre-approval to closing.

By leveraging the FHA Purchase New Jersey program, you can overcome some of the common barriers to homeownership and embark on your journey to finding your dream home. Whether you're seeking the vibrant city life of Newark, the coastal charm of Atlantic City, or the suburban tranquility of Princeton, FHA loans can help you make your homeownership dreams a reality in the diverse and picturesque state of New Jersey.

Call 800-516-9166

How to Qualify for an FHA Purchase New Jersey?

To qualify for an FHA Purchase New Jersey, you need to meet certain requirements set by the Federal Housing Administration. Here are the key factors to consider:

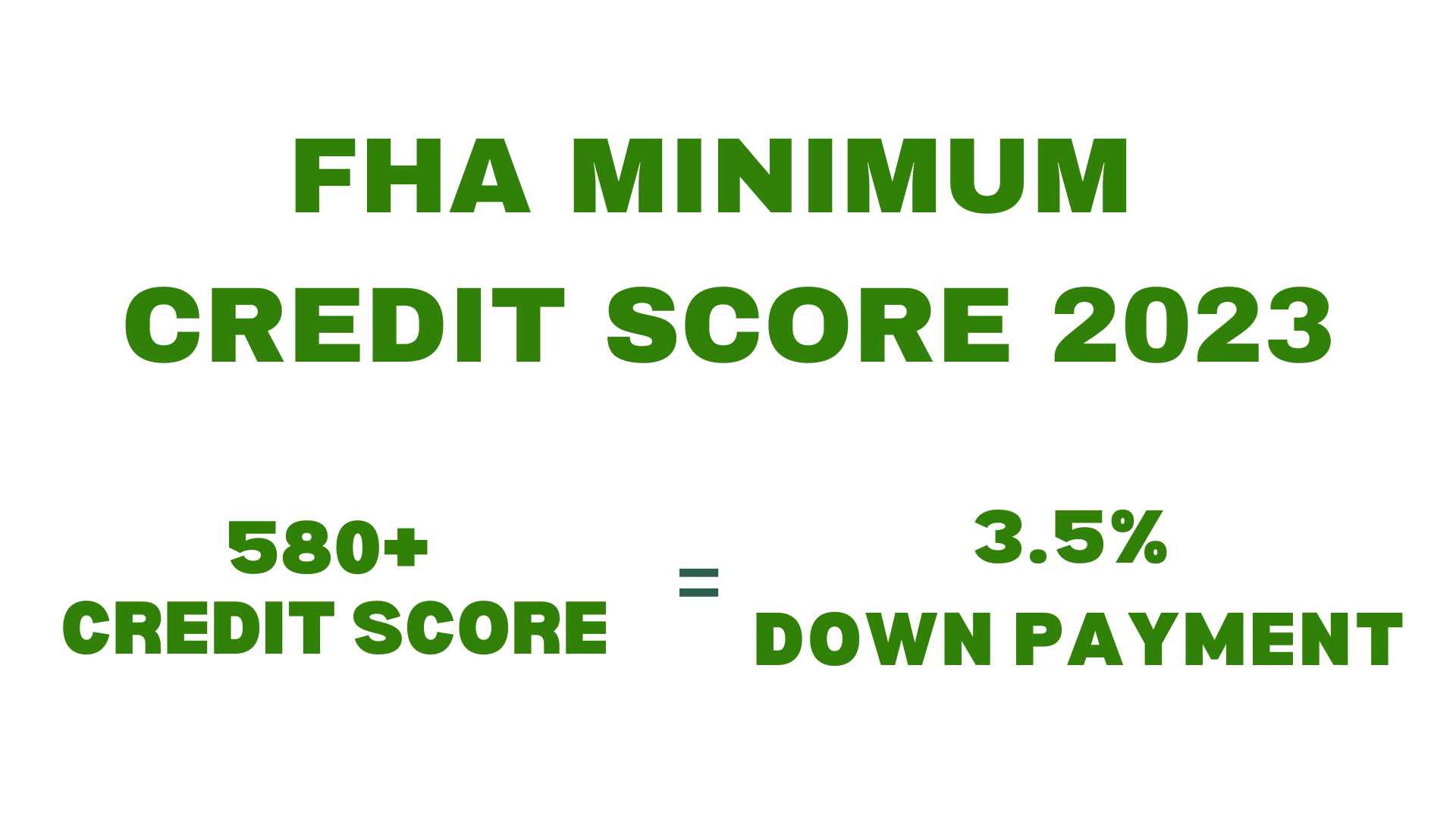

Credit Score

While FHA is more lenient than conventional lenders, they still have minimum credit score requirements. Generally, a credit score of 580 or higher will allow you to qualify for an FHA loan with a 3.5% down payment. If your credit score is between 500 and 579, you may still be eligible but will need to make a larger down payment of at least 10%. Even if you do not have a credit score, you can still qualify for an FHA loan with 3.5% down payment.

Employment and Income Stability

Lenders will review your employment history and income stability to ensure you can afford the mortgage payments. Generally, you should have a steady employment history for at least two years and a stable or increasing income. Self-employed individuals will need to provide additional documentation, such as tax returns and profit/loss statements.

Debt-to-Income Ratio

The FHA imposes specific limits on your debt-to-income (DTI) ratio, which compares your monthly debt payments to your gross monthly income. Typically, your DTI ratio should be no higher than 43%. This includes your mortgage payment, including principal, interest, taxes, and insurance (known as PITI), along with other monthly debts like car loans, student loans, and credit card payments.

Down Payment

FHA purchase New Jersey requires a minimum down payment of 3.5% of the purchase price. The down payment can come from your savings, a gift from a family member, or a down payment assistance program. Keep in mind that the higher your down payment, the lower your monthly mortgage insurance premiums will be.

Property Requirements

The property you're purchasing must meet certain standards outlined by the FHA. This includes criteria for safety, soundness, and security. An FHA-approved appraiser will assess the property to ensure it meets these standards.

Residency Status

FHA purchase loans are available to U.S. citizens, permanent residents, and non-permanent residents with valid work visas. You will need to provide documentation to prove your residency status.

Loan Limits

FHA purchase loans have maximum loan limits that vary by county. These limits determine the maximum amount you can borrow using an FHA loan. It's important to check the loan limits for the county in which you are purchasing a property.

To begin the process, call us today at 800-516-9166 or apply below and we can guide you through the application and approval process. We will help you gather the necessary documentation and ensure you meet all the requirements for an FHA loan.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Call 800-516-9166

Call Now, Our Staff is Available!

888-958-4228