Purchase - Conventional vs FHA

I want to purchase a home, which program do i qualify for?

Purchase - FHA or conventional mortgage?

There are several types of conventional loan programs that you may qualify for. Each program has different down payment, credit score, property type and loan-to-value requirements.

Fannie Mae and Freddie Mac have several programs for first time home buyers with a low-down payment.

- My Community program requires a minimum down payment of 3%. The borrower’s income cannot exceed 100% of the annual HUD Area Median Income for the subject property’s location.

- Home Possible® program requires a minimum down payment of 3%. First Time Home Buyers must participate in a home ownership education program. 40-year fixed rate Home Possible® mortgage.

- Community Solution loans provide additional flexibilities for teachers/educational institution employees, firefighters, police, healthcare workers and military personnel.

- HomeChoice loans offer borrowers with a disability or who have a family member with a disability who may need greater underwriting flexibilities, including non-occupying co-borrowers.

- HomePath® program is a fixed-rate, fully amortizing loan program

that provides the financing for properties that are owned by Fannie Mae as a

result of foreclosure or other similar action such as a deed-in-lieu.

- Conforming loans that promote home ownership for first time home buyers with programs that offer a low-down payment.

- Conforming High Balance are mortgages originated using higher maximum loan limits that are permitted in designated high-cost areas.

Fannie Mae and Freddie Mac require a minimum credit score of 620 to buy a home. Their mission is to help ensure that home buyers and homeowners have access to mortgage financing.

Government loans

There are several types of government loan programs that you may qualify for. Each program has different down payment, credit score, property type and loan-to-value requirements

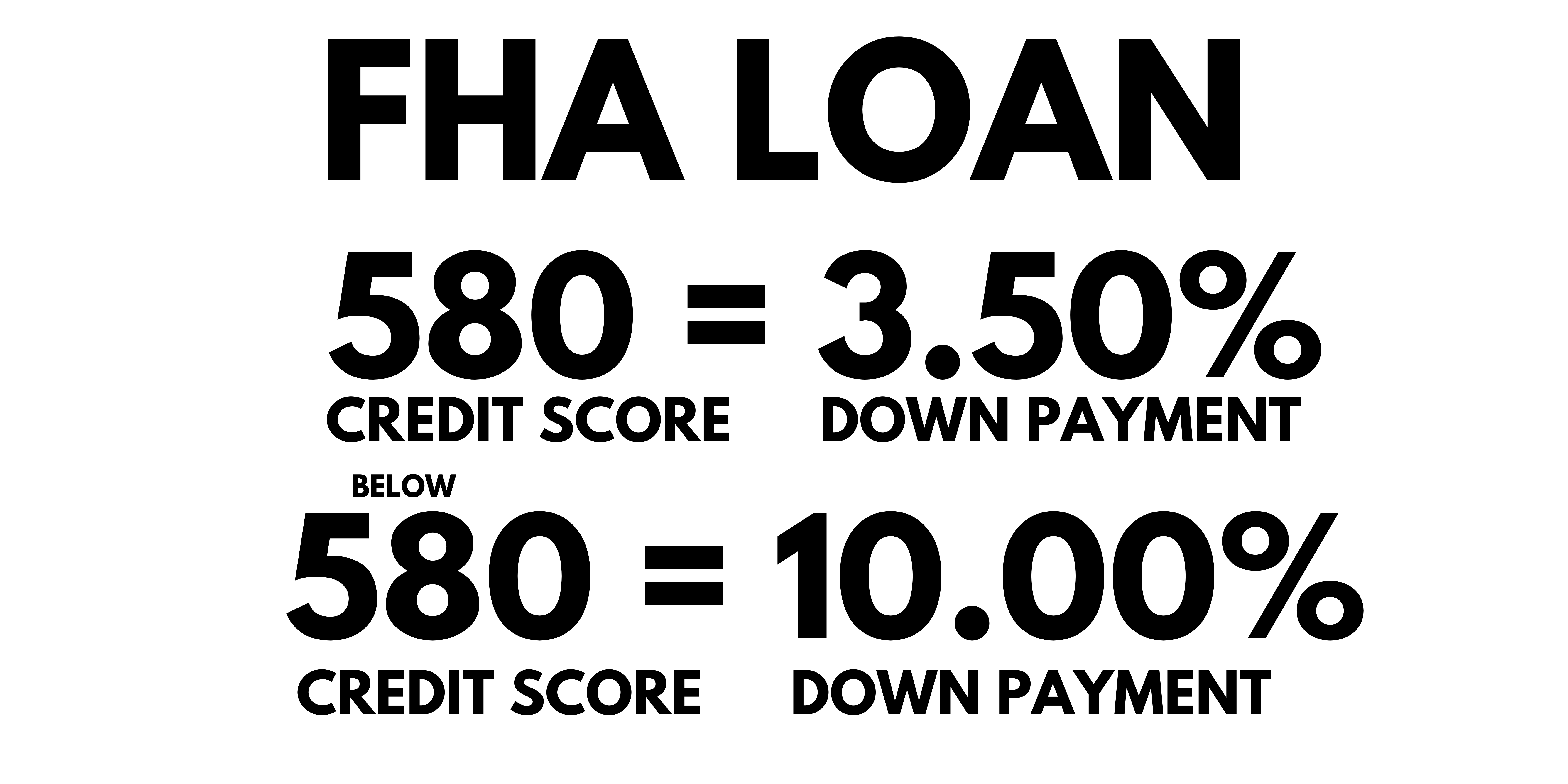

FHA requires a minimum credit score of 500. There are no income limits like you may find with first time home buyer programs. However, there are limits on how much you can borrow.

- 203(b) program provides mortgages for home buyers to purchase a principal residence with a low-down payment and with lower credit standards.

- 203(k) program is for the rehabilitation and repair of single-family properties. Providing both the financing to purchase a property and the financing to make repair. The program offers an important tool for expanding homeownership opportunities.

- HUD $100 down payment program for borrowers purchasing single-family HUD Real Estate Owned (REO). The program is limited to owner-occupant buyers who have not purchased a HUD REO property within the last 24 months.

HUD's mission is to support the nation’s housing market.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Call 888-958-5382

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…