Credit Score Requirements for FHA 2024

What are the Credit Score Requirements for FHA 2024?

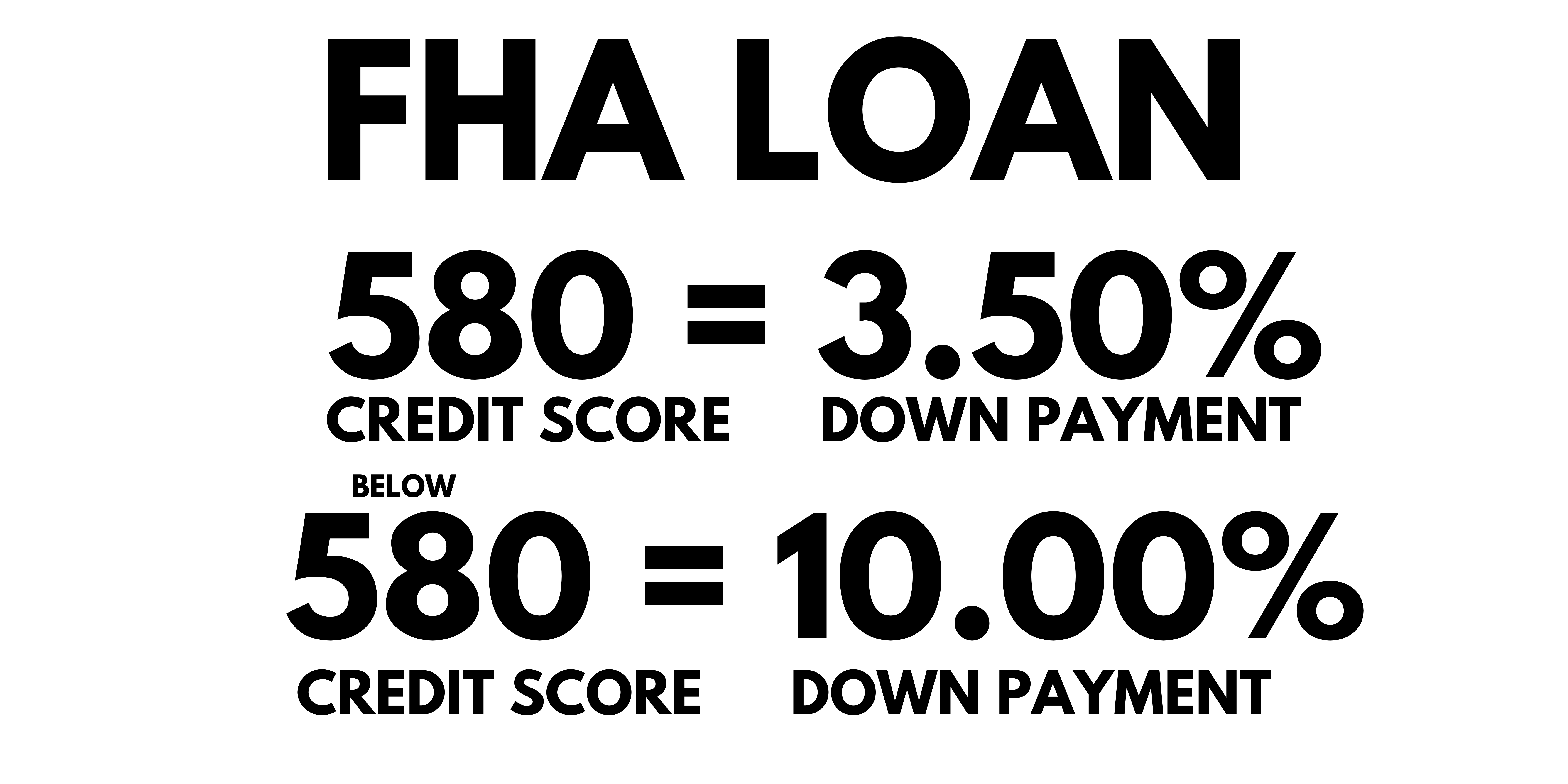

Improving your credit history and maintaining a good credit score is indeed beneficial when applying for an FHA loan. The minimum credit score required to qualify for an FHA loan with a low down payment advantage is currently 580. However, if your credit score is below 580, you may still be eligible for an FHA loan by putting down a 10 percent down payment.

Remember, improving your credit history and score takes time and discipline. It's important to establish good financial habits and maintain them consistently. Working towards a higher credit score can not only increase your chances of qualifying for an FHA loan but also benefit you in obtaining favorable terms and interest rates for other types of loans in the future.

Credit Score Requirements for FHA 2024

Having a Good Credit History and Higher Credit Scores Can Offer Several Advantages when Applying for an FHA Loan

Credit Score Requirements for FHA 2024

- Easier Qualification: FHA loans have more lenient requirements compared to traditional mortgage loans, making it easier for applicants with lower credit scores or questionable credit history to qualify.

- Competitive Interest Rates: FHA loans often offer lower interest rates, which can help borrowers afford their housing payments more comfortably compared to subprime loans with higher rates.

- Lower Fees: FHA loans typically have lower costs associated with them, including closing costs and mortgage insurance premiums, making homeownership more affordable.

- Bankruptcy/Foreclosure Consideration: The FHA considers applicants who have experienced bankruptcy or foreclosure in the past, as long as they meet other requirements such as re-establishment of good credit and a solid payment history.

- No Credit History: If you don't have a sufficient credit history, you may still be able to qualify for an FHA loan by using substitute forms of credit to demonstrate your financial responsibility.

How Do I Make The Most of My Credit and Improve My Chances of Qualifying for an FHA Loan?

- Check your credit report: Obtain copies of your credit reports from the three major credit bureaus (Experian, TransUnion, and Equifax) and review them for any errors or discrepancies. If you find any inaccuracies, dispute them and have them corrected.

- Pay bills on time: Make all your payments, including credit cards, loans, and utilities, on time to demonstrate responsible financial behavior.

- Reduce debt: Pay down your existing debts, particularly credit card balances, to lower your overall debt-to-income ratio and improve your credit utilization ratio.

- Avoid new credit applications: Minimize applying for new credit, as multiple inquiries within a short period can negatively impact your credit score.

- Keep credit utilization low: Try to keep your credit card balances below 30 percent of your available credit limit to maintain a healthy credit utilization ratio.

FHA Credit Score Requirements for FHA 2024

Remember, improving your credit history and score takes time and discipline. It's important to establish good financial habits and maintain them consistently. Working towards a higher credit score can not only increase your chances of qualifying for an FHA loan but also benefit you in obtaining favorable terms and interest rates for other types of loans in the future.

What is the Application Process for FHA Loans?

- Preparing for the application: Before applying for an FHA loan, gather the necessary documents, such as proof of income, employment history, tax returns, bank statements, and identification.

- Find an FHA-approved lender: Mortgage-World.com is approved to originate all types of FHA Loans. You can call us at 888-958-53826 or apply online now.

- Complete the loan application: Fill out the loan application provided by Mortgage-World.com. You will need to provide personal, financial, and property information.

- Provide documentation: Submit the required documentation to support your loan application. This may include income verification, bank statements, tax returns, and any other documents requested by underwriting.

- Credit check and appraisal: We will order a credit check to review your credit history and assess your creditworthiness. Additionally, an appraisal of the property will be conducted to determine its value and ensure it meets FHA guidelines.

- Underwriting and loan approval: Underwriting will evaluate your application, including the credit check, appraisal, and documentation, to determine if you meet the FHA loan requirements. If approved, you will receive a loan commitment letter.

- Closing process: Once the loan is approved, you will need to review and sign the loan documents. This typically takes place at a title company or attorney's office. You may need to pay closing costs, which can include fees for processing the loan, title insurance, and other related expenses.

- Loan funding: After all the documents are signed and the closing process is complete, the lender will fund the loan. This means they will provide the funds necessary to purchase the property.

It's important to note that the exact application process may vary slightly depending on specific circumstances. Working closely with an experienced loan officer can help guide you through the process and ensure a smooth application experience.

FHA Credit Score Requirements for FHA 2024

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Call Now, Our Staff is Available!

800.516.9166